Let me paint a picture here. Things are looking good.

You’re 50 years of age, happily married, living in your forever home with no debt. Your kids have all left school and are starting to fend for themselves. You’re at the peak of your powers professionally and are looking to retire by 60.

Suddenly you have a massive windfall. You inherit from a long-lost uncle, sell an asset, or win lotto. You are now in an entirely different cash position than you were earlier in the week and are totally confused by the infinite choices in front of you. More money, more problems.

You decide to go and seek the counsel of 10 of the best financial advisers in your city, assuming there are 10, and they all repeat, “put it in to super pal”, which seems strange. Are they all some kind of colluding robots, shouldn’t their different backgrounds, experiences and education lead them to different perspectives. Or am I missing something?

Sorry to be the one to tell you this, but it’s you Jim.

Look, I’m happy to hear your personal gripes about superannuation, “the government keeps changing the rules” or “mine hasn’t returned much”. But I’ve heard them all before. If I had a dollar for every time I’ve said “super isn’t an investment, it’s a piece of legislation” I’d have lots of dollars.

So, first things first. Plopping some money into superannuation and then investing that money are two decisions not one. You can put $1,000 into your super and direct it towards cash or you can put $1,000 into your super and direct it towards shares. Choice #1 doesn’t drive the return, choice #2 does.

Let’s look at it another way.

You’ve had your eye on a property for a few years, purely investment, and it becomes available to buy. Now, with your newfound cash, you’re thinking of just buying it in your name and renting it out.

Simple. Not simple Jim.

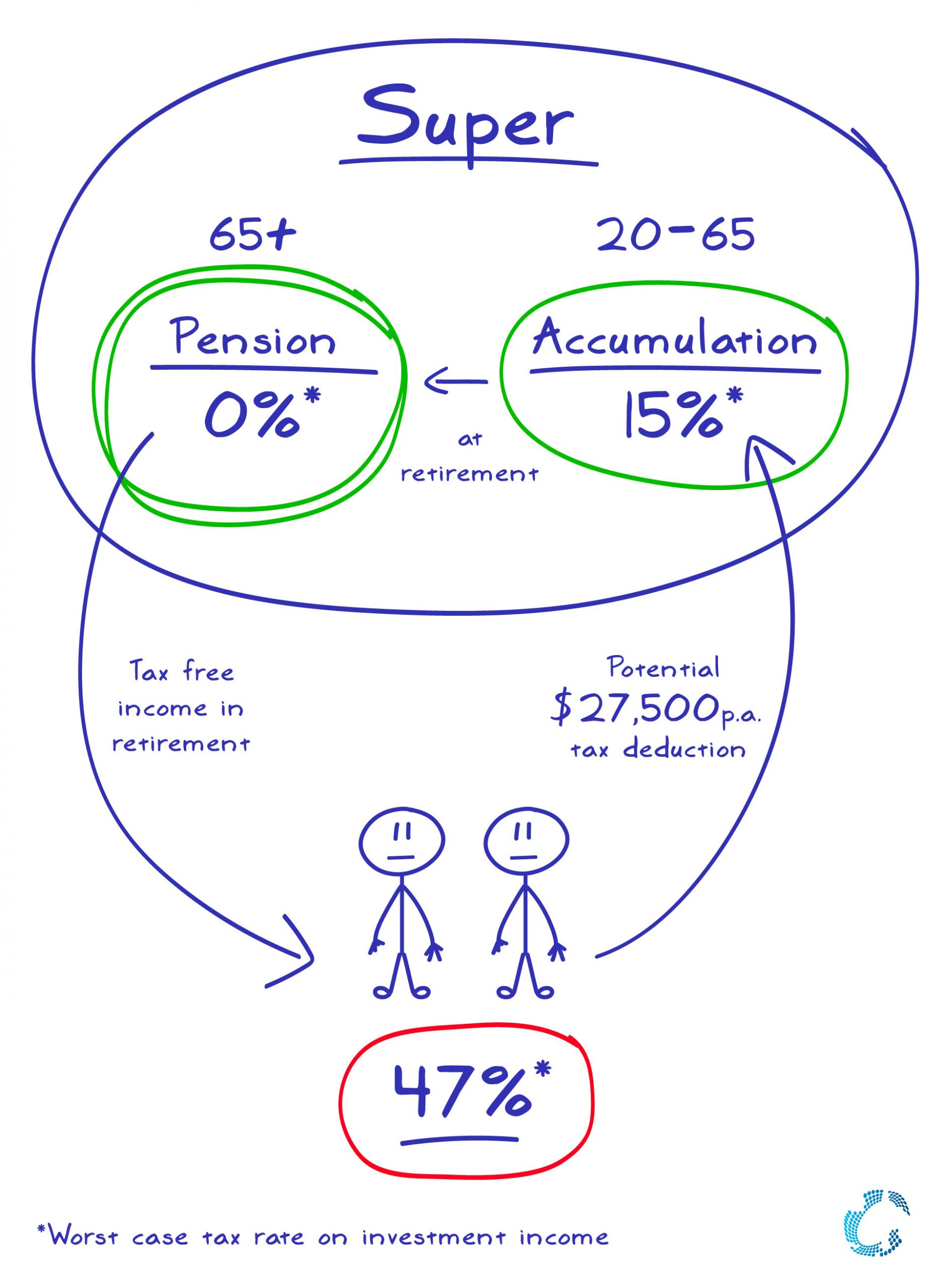

The worst-case tax scenario on both the rent and capital gains tax upon selling (if you sold inside 12 months or while you were a tax non-resident) is 47%. That’s pretty much half.

Now, if you were to make things slightly more complex, obviously one of the drawbacks and there are others, and purchased the same property via superannuation your worst-case tax scenario is 15%. Best case scenario, post-retirement at 60, assuming your fund is a normal size, is no tax. No tax on rental income and no tax upon selling.

A lot of people will argue that negative gearing is the best thing since sliced bread, and put said property solely in the name of the highest income earner to get the most tax back. But all you’re doing then is ensuring that you hand all your tax savings back when the property gets sold in the highest income earners name down the track.

Notice how we’re not talking about the performance of the property? Because it has nothing to do with the decision, it’s common across both scenarios so we remove it from the equation. We’re only talking tax here and access to the money.

Look, access to Super is a huge issue so maybe I should address that.

You put money into super, money stays in super (generally). You can’t touch until 65 at the latest, a bit earlier if you retire from work.

But these access issues aren’t equal to everyone. They’re a little too big to jump over for a 30-year-old with a home loan. But for a 58-year-old in a strong position they’re almost non-existent.

And here is another little nugget for you that is surprisingly not understood at all. When you stop working and your employer stops paying you, the first thing we’ll do is replace said salary, dollar for dollar if you’d like, with a payment from your superannuation. Every Thursday, tax free, for the rest of your life if you have enough.

It’s rather shocking how little this is understood. Employment income turns off, superannuation income turns on. It’s called a pension, not to be confused with an age pension that comes from Centrelink.

So this is it Jim, this is why all 10 advisers will tell you to put your money into super, as much as possible as quickly as possible. If you then want to put that money into term deposits wonderful, shares absolutely, property why not. All three, even better.

Don’t confuse the recommendation to put money into super, with a recommendation of how to invest the money. They are two totally different beasts.